-

-

- 메일 공유

-

https://dev.stories.amorepacific.com/en/amorepacific-chief-executive-qa-session-summary-by26-team-amore-conference-recap

Chief Executive Q&A Session Summary | BY26 Team AMORE Conference Recap

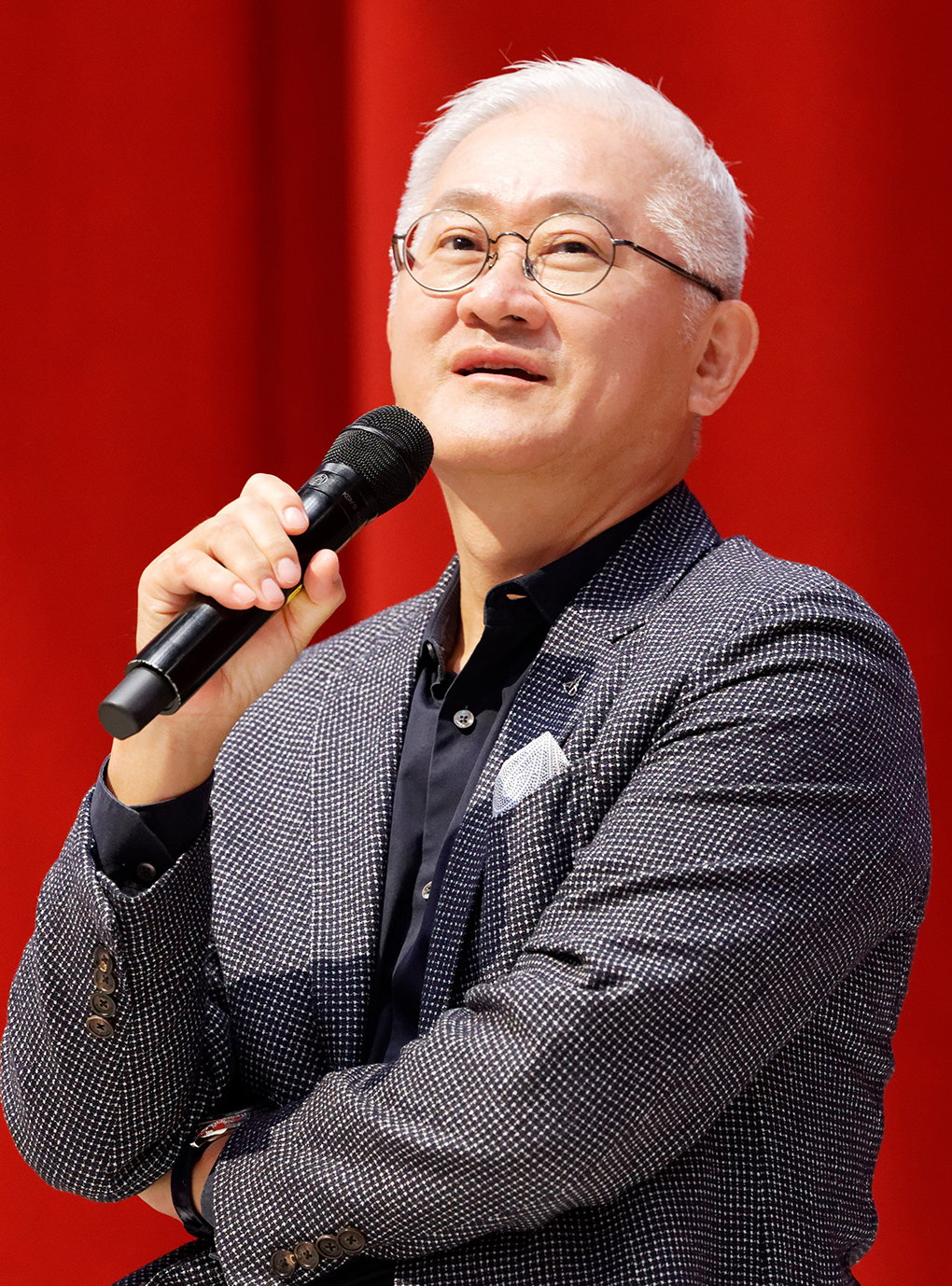

On Tuesday, August 19th, building on the July kickoff of BY26, the BY26 Team AMORE Conference was held at our Global Headquarters to share this year's business strategy and direction with the entire company.

Prior to the conference, employees submitted questions regarding the company's business strategy. A Q&A session was held during which our three chief executives provided direct answers.

We are pleased to share this summary of the employee questions and executive responses from the BY26 Team AMORE Conference Q&A session.

Discover more through the key takeaways outlined below.

(This document contains key company strategies. Recording and external distribution are prohibited.)

- Q1.

- I feel that the company's overall momentum has improved quite a bit recently. Mr. Suh, I am curious to hear your personal assessment of BY25's performance. What do you believe is the most critical area to focus on to carry this positive momentum into BY26?

-

BY25 can be summed up in one phrase: “Good Sales, Good Profit.”[1] This year's performance is profoundly meaningful as it signifies an improvement in the fundamental structure of company. We were able to achieve these outstanding outcomes thanks to the tireless efforts of everyone involved in refining our sales practices, expanding into the ‘Pentagon Markets’ including the United States, and shifting our communication focus to social media and mobile platforms. My sincere thanks to all of you for your hard work in BY25.

BY25 can be summed up in one phrase: “Good Sales, Good Profit.”[1] This year's performance is profoundly meaningful as it signifies an improvement in the fundamental structure of company. We were able to achieve these outstanding outcomes thanks to the tireless efforts of everyone involved in refining our sales practices, expanding into the ‘Pentagon Markets’ including the United States, and shifting our communication focus to social media and mobile platforms. My sincere thanks to all of you for your hard work in BY25.

To successfully execute the strategy previously introduced by Mr. Seunghwan Kim (click to view), we need passion and teamwork. Building on our ‘Dynamic Capabilities,’[2] we must advance our approach to new markets, new channels, and new communication methods. In addition, we must leverage artificial intelligence and data to go about our work with greater specificity, efficiency, and precision. If we rapidly transform our ways of working and proactively approach new markets, I am confident we can achieve outstanding results in BY26 as well. I look forward to your continued dedication.

-

[1] One of the principles of the AP MUST-DO INITIATIVE. We refer to the sales and profits resulting from the accumulation of brand value as ‘Good Sales/Good Profit.’

[2] The most important capabilities, arising from continuously changing customers, distribution processes, and competition; about adapting to changes and adjusting to new environments.

- Q2.

- The influence of K-Indie brands in the global beauty market has been rising rapidly. I'm curious about the differentiated strategies we are preparing to respond to rapid trend changes and prepare for the future.

-

Our origins are fundamentally different from those of indie brands, giving each of us distinct advantages and disadvantages. Ultimately, the key to success lies in maximizing one's own strengths while mitigating weaknesses.

Our origins are fundamentally different from those of indie brands, giving each of us distinct advantages and disadvantages. Ultimately, the key to success lies in maximizing one's own strengths while mitigating weaknesses.The strengths of indie brands include: △ the speed and flexibility of a small organization; △ a high sensitivity to digital trends; and △ the willingness to boldly embrace high-risk, high-return ventures. In contrast, our strengths are stable and scalable: △ technological and product capabilities unattainable through ODM; △ a broad portfolio of categories and brands; △ a robust corporate structure; and △ significant negotiating power with retailers.

Through our collaboration with COSRX since 2021, we are learning from their pioneering capabilities, product excellence, and overseas business acumen, while also observing the challenges that indie brands face. Leveraging our own experience and know-how in overcoming such issues will further enhance our competitiveness in the global market. Additionally, we will continue to expand our capabilities in the global beauty landscape through investments in other brands and a dedicated inorganic growth strategy.

-

- Q3.

- There has been a lot of noise recently about tariff issues with the United States. Given our high expectations for the North American market, I believe this poses a risk to us. I’m curious about the company's response strategy. Having experienced the similar previous issues in China, I feel even more concerned and would like to ask for your perspective on this matter.

-

Tariffs are a common challenge to all global corporations. Regarding the U.S. tariffs, our North America RHQ is in close communication with our retail partners, actively exploring various strategies, including price adjustments, to minimize the impact.

Tariffs are a common challenge to all global corporations. Regarding the U.S. tariffs, our North America RHQ is in close communication with our retail partners, actively exploring various strategies, including price adjustments, to minimize the impact.Our business in China faced immense difficulties stemming from the Hallyu crisis in 2014, the THAAD issue in 2017, and the COVID-19 pandemic in 2020. This was because we did not fully recognize the changing tides and lacked a swift response.

What is truly essential is how quickly we move after directly confronting change and problems.

Likewise, in the U.S. market, the key is the agility of our response. In this era of media commerce, success hinges on how well we master e-commerce platforms like TikTok and Amazon, and how effectively we engage with social media. Establishing a strong presence in multi-brand stores such as Sephora, Ulta, and Target, and strategically leveraging influencers, are also critical.

Our acquisition of COSRX was not driven by revenue. The primary reason was to transform our momentum. When the new dynamism we've gained is fused with our fundamental strengths—our technology, branding, and distribution relationships—we will be able to draw upon even greater resources.

Crises will continue to emerge. However, if we focus our minds, we can overcome them. I have unwavering faith that you will continue to succeed, just as you have demonstrated so admirably over the past few years.

-

- Q4.

- AESTURA is the undisputed leading derma brand in Korea, but in overseas markets, it must compete with major brands like La Roche-Posay and Vichy. What are the BY26 business strategies and direction to ensure AESTURA and ILLIYOON can succeed abroad?

-

The derma category is a global trend, growing more than twice as quickly as general skincare, and it is a category where we absolutely must prevail. We have steadily expanded our presence in the derma space with AESTURA, ILLIYOON, and COSRX, as well as AP Beauty and IOPE.

The derma category is a global trend, growing more than twice as quickly as general skincare, and it is a category where we absolutely must prevail. We have steadily expanded our presence in the derma space with AESTURA, ILLIYOON, and COSRX, as well as AP Beauty and IOPE.Moving beyond our traditional focus on soothing and moisturizing, we are expanding into the procedural and clinical realms. Each brand possesses distinct strengths across different price points, channels, and customer segments. When combined, they form a formidable derma portfolio on the global stage. The establishment of the Derma Unit and Active Unit organizations for BY26 is an integral part of this strategy.

For the specific strategies, I will ask Woonsub Lim of the Derma Beauty Unit and Jongha Kim of the Active Beauty Unit to respond.

-

-

By BY30, we will have cultivated AESTURA and ILLIYOON into premier global brands.

Woonsub Lim,

Derma Beauty UnitThis year (BY26) is a period of full-scale global expansion for AESTURA and one of preparation for global expansion for ILLIYOON.

For AESTURA, we will expand our market presence through Sephora and local channels. The response from the U.S. Sephora launch (February 2025) has been tremendous, and we now plan to expand into many new markets including Canada, Australia, the UK, and Europe.

ILLIYOON is the number one derma and body moisturizing brand in Korea. Starting in BY26, we will enter the e-commerce markets in the U.S. and Japan to further expand our customer base with plans to expand into offline channels in BY27.

In BY26 and BY27, both AESTURA and ILLIYOON will deliver definitive results on the global stage. We are committed to achieving the highest performance in the coming period and ask for your enthusiastic support and encouragement.

-

-

This is the era of derma and the era of efficacious ingredients, with a clear trend of consumers directly learning about and choosing products based on the effects of active ingredients such as retinol and Vitamin C. Concurrently, the market combining medical and cosmetic solutions is growing. AP Beauty will target the high-end and luxury segments, while IOPE will target the remainder of this crucial market.

Jongha Kim,

Active Beauty UnitIOPE is taking on the global market, armed not with ordinary retinol, but with Retinol RX, and our XMD line, which emulates the effects of dermatological procedures without the need for surgical needles. A full launch across all U.S. Sephora stores has already been confirmed, and we will begin our global business promotion efforts in earnest next March. I invite you to watch IOPE’s exciting journey unfold.

-

- Q5.

- To achieve this year's goals, what capability enhancements or cultural changes do you believe are necessary within the organization?

-

For our company to become more robust and resilient, a change in corporate culture is imperative. The very first act of Microsoft's Satya Nadella upon his appointment as CEO was to transform the company's culture. Similarly, the reason Amazon acquired Zappos was to learn from its unparalleled customer-centric culture.

We too must create a new culture that embodies the changed spirit of our times. We have dubbed this initiative ‘Dynamic AP,’ and it will emerge as a project that transforms our very way of working, centered on dynamic capabilities. The HR department is currently preparing this initiative and will be communicating with all of you shortly. I believe that with the two wings of our visions of New Beauty and Dynamic AP, our company will soar to even greater heights. I ask for your keen interest and active participation.

-

- Q6.

- As we begin BY26, what message would you, as CEO, like to convey to the company’s employees?

-

The most important thing for us is our customers. We must be present where our customers are. The reason we named this building the Global Headquarters stems from our heartfelt desire for all of you to grow closer to our global customers and to flourish as global talent.

The most important thing for us is our customers. We must be present where our customers are. The reason we named this building the Global Headquarters stems from our heartfelt desire for all of you to grow closer to our global customers and to flourish as global talent.To grow into a world-class enterprise, we require, above all, tenacity and a customer-centric spirit. Walmart is a case in point. It began as a small supermarket, but while fiercely competing against titans like Kmart, Kroger, Costco, and Amazon, it survived by coming up with new ideas to overcome crises and bold new ways to serve its customers.

We are no different. We must be present where customers form opinions and gather information—at the touchpoints of social media, offline retail, and e-commerce. The share of e-commerce will grow to 70% in the future, and only those companies that delight their customers will survive.

You may fall on the path towards eventual success. What matters is how you fall. We must not fall while backpedaling; we must fall while moving forward. Only then can we learn and become stronger. I want to walk with all of you, with tenacity, falling forward. Let us be present where our customers are and build a stronger

-

-

Like

0 -

Recommend

0 -

Thumbs up

0 -

Supporting

0 -

Want follow-up article

0

Array ( )